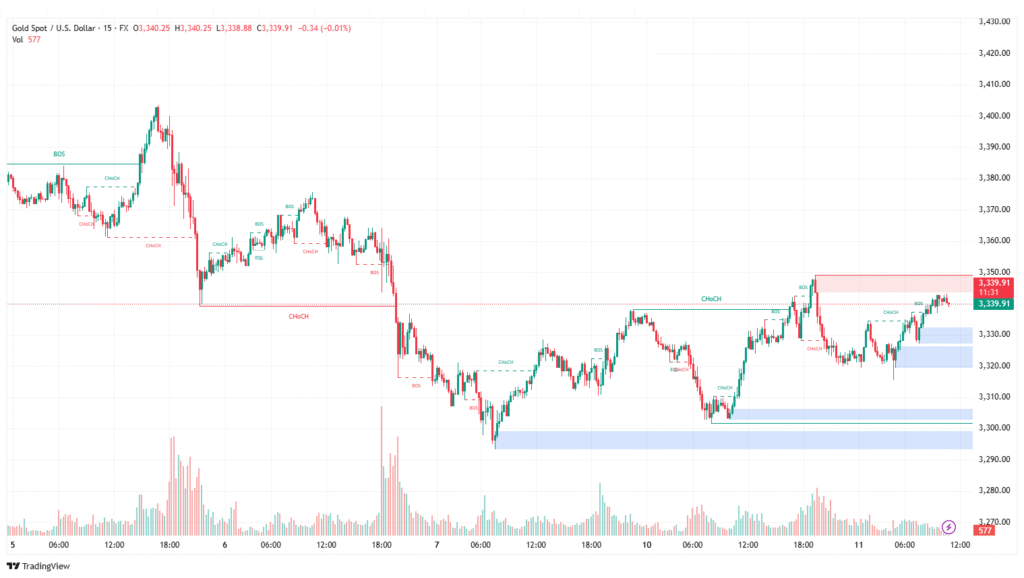

The current market structure of XAUUSD shows a bearish bias with short-term bullish retracement, as identified through Smart Money Concepts (SMC), Volume Spread Analysis (VSA), and Price Action. On the 30-minute timeframe, a major Change of Character (CHoCH) occurred below 3340, confirming a bearish shift following multiple Breaks of Structure (BOS). Price recently tapped into a demand zone around 3290-3310, where significant volume spikes suggest accumulation, and has since rallied towards the supply zone at 3345-3360. On the 5-minute chart, this rally is confirmed by multiple bullish BOS, though equal highs near 3345-3350 hint at a liquidity pool that may attract a final price push before a reversal. VSA indicates caution among buyers as recent up-moves near resistance are accompanied by diminishing volume, signaling a possible lack of demand or supply entering the market. The 15-minute chart further supports this outlook, revealing a strong rally into supply after a liquidity sweep at 3290, followed by minor rejections and low-volume candles near resistance, suggesting buyers’ hesitation. Taken together, these signals point to a high-probability short setup around 3345-3350, where a liquidity grab may trigger a reversal. A suggested short entry would be in this supply zone, with stop-loss placement above 3360 to account for potential stop hunts, and multiple take-profit levels at 3315, 3290, and potentially 3265 if bearish momentum continues. Alternatively, if price breaks above 3360 with strong volume, the bearish setup would be invalidated, opening the door for a bullish continuation toward 3380 and 3400. The bias remains short for now, with careful monitoring for confirmation signals before execution.